Session Times

THE 3-SESSION SYSTEM

One of the interesting features of the International Financial market is that it is open 24 hours a day. Around the clock trading allows investors from across the globe to trade during normal business hours, after work, or even in the middle of the night.

Although there is always a market for the most liquid asset classes called currency pairs, there are times when price action is consistently volatile and periods when it is muted. What’s more, different currency pairs exhibit varying activity over certain times of the trading day due to the general demographic of those market participants who are online at the time.

In this article, we will cover three major trading sessions, explore what kind of market activity can be expected over the different periods,

and show how this knowledge can be adapted into a trading plan.

BREAKING DOWN ROUND THE CLOCK CURRENCY MARKET

Currencies offer a considerable advantage for many institutional and individual traders because it guarantees liquidity and the opportunity to trade at any conceivable time. However, although currencies can be traded anytime, an individual trader can only monitor a position for so long.

KEY TAKEAWAYS

Currencies Session can be broken down into three manageable trading periods.

Traders often focus on one of the three trading periods, rather than attempt to trade the markets 24 hours per day.

Peak activity periods are the Asian, European, and North American sessions, which are also called Tokyo, London, and New York.

Sometimes sessions will overlap, such as a four-hour period for peak activity in both Europe and North America.

Since most traders can’t watch the market constantly, there will be times of missed opportunities, or worse—when a jump in volatility leads to a movement against an established position when the trader isn’t around. For this reason, a trader needs to be aware of times of market volatility and decide when it is the best to minimize this risk based on their trading style.

Traditionally, the market is separated into three peak activity sessions: the Asian, European, and North American sessions, which are also referred to as the Tokyo, London, and New York sessions. These names are used interchangeably, as the three cities represent the major financial centers for each of the regions. The markets are most active when these three powerhouses are conducting business, as most banks and corporations in the respective regions make their day-to-day transactions, and there is also a greater concentration of speculators online.

ASIAN SESSION (TOKYO)

When liquidity is restored at the start of the week, the Asian markets are naturally the first to see action. Unofficially, activity from this part of the world is represented by the Tokyo capital markets and spans from midnight to 6 a.m. Greenwich Mean Time (GMT).

There are many other notable countries that are present during this period including China, Australia, New Zealand, and Russia. Considering how scattered these markets are, it makes sense that the beginning and end of the Asian session are stretched beyond the standard Tokyo hours. Asian hours are often considered to run between 11 p.m. and 8 a.m. GMT, accounting for the activity within these different markets.

EUROPEAN SESSION (LONDON)

The European session takes over in keeping the currency market active just before the Asian trading hours come to a close. This FX time zone is very dense and includes a number of major financial markets that could stand in as the symbolic capital.

London has taken the honors in defining the parameters for the European session to date. Official business hours in London run between 7:30 a.m. and 3:30 p.m. GMT. This trading period is also expanded due to other capital markets’ presence (including Germany and France) before the official open in the U.K, while the end of the session is pushed back as volatility holds until after the close. Therefore, European hours typically run from 7 a.m. to 4 p.m. GMT.

YOUR SMART INVESTMENT FINANCE MONEY DECISIONS ARE NOW SIMPLER

NORTH AMERICAN SESSION (NEW YORK)

The Asian markets have already been closed for a number of hours by the time the North American session comes online, but the day is only halfway through for European traders. The Western session is dominated by activity in the U.S, with contributions from Canada, Mexico, and countries in South America. As such, it comes as little surprise that activity in New York City marks the high volatility and participation for the session.

When it is Noon GMT on Friday, the time is 8:00 a.m. ET on Friday in New York.Taking into account the early activity in financial futures, commodity trading and the concentration of economic releases, the North American hours unofficially begin at 12 p.m. GMT. With a considerable gap between the close of the U.S. markets and open of Asian trading, a lull in liquidity sets the close of New York trading at 8 p.m. GMT as the North American session closes.

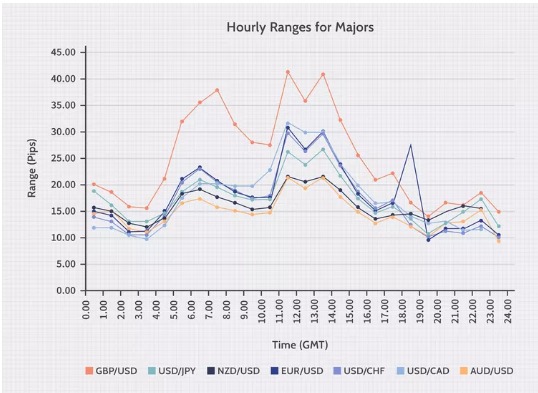

The Asian/European sessions overlap, sometimes creating more volatility, due to increased trading activity during those hours. Figure 3 shows the uptick in the hourly ranges in various currency pairs at 7 a.m. GMT.

If the currency pair is a cross made of currencies that are most actively traded during Asian and European hours (like EUR/JPY and GBP/JPY), there will be a greater response to the Asian/European session overlaps and a less dramatic increase in price action during the European/U.S. sessions’ concurrence. Of course, the presence of scheduled event risk for each currency will still have a substantial influence on activity, regardless of the pair or its components’ respective sessions.

For long-term or fundamental traders, trying to establish a position during a pair’s most active hours could lead to a poor entry price, a missed entry, or a trade that counters the strategy’s rules. In contrast, volatility is vital for short-term traders who do not hold a position overnight.

THE BOTTOM LINE

When trading currencies, a market participant must first determine whether high or low volatility will work best with their trading style. Trading during the session overlaps or typical economic release times may be the preferable option if more substantial price action is desired. The next step would be to decide what times are best to trade, accounting for a volatility bias. A trader will then need to determine what time frames are most active for their preferred trading pair.

When considering the GOLDEURUSD pair, the European/U.S. session crossover will find the most movement. There are usually alternatives to trading in this session, and a trader should balance the need for favorable market conditions with outlying factors, such as physical well-being. If a market participant from the U.S. prefers to trade the active hours for GOLDGBPJPY, they must wake up early in the morning to keep up with the market. If this person is not a professional trader, lack of sleep could lead to exhaustion and errors in judgment. An alternative may be trading during the hours that comprise the European/U.S. session overlap, where volatility is still elevated, even though Japanese markets are offline.