INTEREST RATE

The investment community and the financial media tend to obsess over interest rate—the cost someone pays for the use of someone else’s money—and with good reason. When the Federal Open Market Committee (FOMC) sets the target for the federal funds rate—the rate at which banks borrow from and lend to each other overnight—it has a ripple effect across the entire U.S. economy. This also includes the U.S. stock market. While it usually takes at least 12 months for any increase or decrease in interest rates to be felt in a widespread economic way, the market’s response to a change is often more immediate.

INTEREST RATE THAT IMPACTS STOCKS

The interest rate that moves markets is the federal funds rate. Also known as the discount rate, the rate depository institutions are charged for borrowing money from Federal Reserve banks.

The federal funds rate is used by the Federal Reserve (the Fed) to attempt to control inflation. By increasing the federal funds rate, the Fed attempts to shrink the supply of money available for purchasing or doing things, thus making money more expensive to obtain. Conversely, when it decreases the federal funds rate, it increases the money supply and encourages spending by making it cheaper to borrow. Other countries’ central banks do the same thing for the same reason.

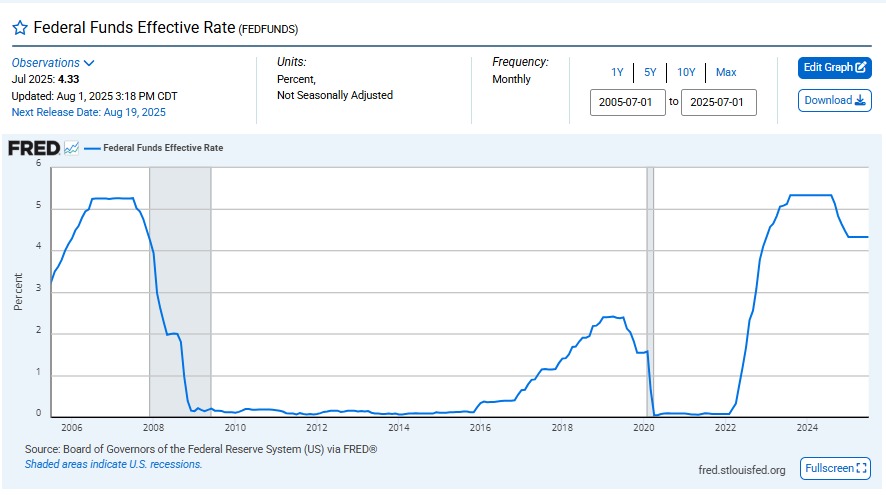

Below is a chart from the Fed showing fluctuations in the federal funds rate over the past 20 years:

Why is this number, what one bank pays to another is so significant? Because the prime interest rate—the interest rate commercial banks charge their most credit-worthy customers—is largely based on the federal funds rate.

It also forms the basis for mortgage loan rates, credit card annual percentage rates (APRs), and a host of other consumer and business loan rates.

WHAT HAPPENS WHEN INTEREST RATES RISE?

When the Fed increases the discount rate, it does not directly affect the stock market. The only true direct effect is that borrowing money from the Fed is more expensive for banks. But, as noted above, increases in the rate have a ripple effect.

Because it costs them more to borrow money, financial institutions often increase the rates they charge their customers to borrow money. Individuals are affected through increases in credit card and mortgage interest rates, especially if these loans carry a variable interest rate. After all, people still have to pay the bills, and when those bills become more expensive, households are left with less disposable income. This means people will spend less discretionary money, which, in turn, affects businesses’ revenues and profits.

But businesses are affected directly as well because they also borrow money from banks to run and expand their operations. When the banks make borrowing more expensive, companies may not borrow as much and will pay higher rates of interest on their loans. Less business spending can slow the growth of a company—it may curtail expansion plans or new ventures, or even induce cutbacks. There may be a decrease in earnings as well, which, for a public company, usually affects its stock price negatively.

WHAT HAPPENS WHEN INTEREST RATES FALL?

When the economy is slowing, the Federal Reserve cuts the federal funds rate to stimulate financial activity. A decrease in interest rates by the Fed has the opposite effect of a rate hike. Investors and economists alike view lower interest rates as catalysts for growth—a benefit to personal and corporate borrowing, which, in turn, leads to greater profits and a robust economy. Consumers will spend more, with the lower interest rates making them feel they can finally afford to buy that new house or send their kids to a private school. Businesses will enjoy the ability to finance operations, acquisitions, and expansions at a cheaper rate, thereby

increasing their future earnings potential, which in turn leads to higher stock prices.

Particular winners of lower federal funds rates are dividend-paying sectors such as utilities and real estate investment trusts (REITs).

Additionally, large companies with stable cash flows and strong balance sheets benefit from cheaper debt financing.

ONLINE TRADING PLATFORM

CUSTOMISABLE CHARTS

Access all the features you need to analyse price movements and conduct technical analysis. We have over 95 technical indicators, chart types and drawing tools built in.

NEWS AND INSIGHTS

Remain up to date with our market calendar and in-built Reuters news stream.

TRADE ON THE MOVE

Our native mobile apps for iPad, iPhone and Android mean you can trade currency pairs wherever you are, anytime.

YOUR SMART INVESTMENT FINANCE MONEY DECISIONS ARE NOW SIMPLER

LEARN TO TRADE CURRENCY PAIRS

When you trade commodities in Futures, you are speculating whether the price of one currency will rise or fall against the other.

Futures are a leveraged product. This means you only need to put down a small initial deposit, known as margin, to enter a trade. Trading using leverage can enhance losses as well as profits, which means any losses you make can exceed your initial deposit on the trade.

Learn and develop

Find out more about currency pairs in our introduction to currency pairs trading.

Trading library

Learn about different trading strategies, as well as fundamental and technical analysis.