Earnings Reports Deliver Varied Results; Hawkish Inflation Figures Dampen Expectations for Rate Cutsa

- rabeelrana

On Friday, US stock futures showed negative trends, experiencing declines of approximately 0.5% each across the three major averages, marking the initiation of the earnings season. In premarket trading, Delta Airlines witnessed a decline of over 5%, despite surpassing expectations for both earnings per share (EPS) and revenue. The airline expressed optimism about another robust year of travel. Concurrently, UnitedHealth Group saw a premarket decline of about 5.5% following the release of earnings that exceeded expectations.

However, concerns arose as the company reported a higher-than-expected utilization of medical services. These developments in the premarket hours reflect the early sentiments and potential market reactions to the earnings reports, adding a layer of complexity to the unfolding market dynamics. Ahead of the opening bell, BlackRock exhibited marginal changes despite surpassing expectations for both earnings and revenue. The market awaited insights into the performance and outlook of these major financial institutions. In a contrasting development, Tesla shares faced a premarket decline of over 3% after the company disclosed its decision to temporarily halt production at its Berlin plant.

This decision was attributed to conflicts in the Red Sea, leading to shifts in transportation routes between Europe and Asia via the Cape of Good Hope. The market responded to this news, with investors assessing the potential impact on Tesla’s production capabilities and its broader supply chain. The unfolding scenarios underscored the intricate interplay of global events and corporate decisions shaping the dynamics of financial markets.

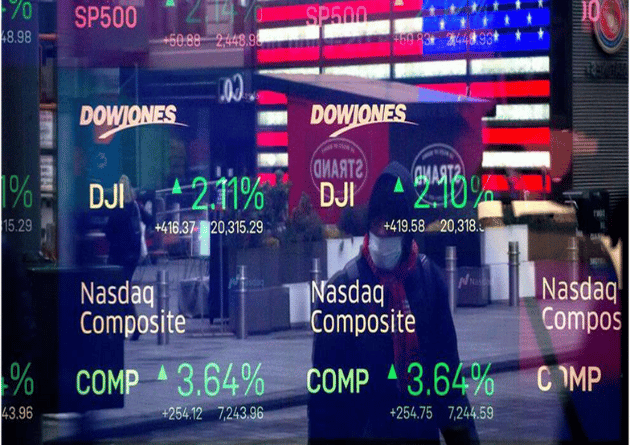

During the standard trading session on Thursday, the Dow experienced a slight increase of 0.04%, while the S&P 500 saw a marginal decline of 0.07%, and the Nasdaq Composite remained unchanged. These market movements coincided with the release of the latest Consumer Price Index (CPI) report, revealing that headline inflation surpassed expectations, reaching 3.4%. However, the core inflation rate, which excludes volatile food and energy prices, fell slightly less than anticipated, registering at 3.9%. The market’s reaction reflected the impact of the inflation data on investor sentiment, as higher-than-expected headline inflation figures can influence market expectations and potentially impact various sectors.

As a result of the latest Consumer Price Index (CPI) report, investors made slight adjustments to their expectations for a rate cut by the Federal Reserve in March, reducing the probability to approximately 65%, down from the previous estimate of 70%. The inflation data influenced market perceptions of potential monetary policy adjustments. Looking forward, investors are eagerly awaiting Friday’s release of the producer price index report, which provides additional insights into inflation from a producer’s perspective. Furthermore, the upcoming earnings reports from major banks, including JPMorgan Chase, Citigroup, Bank of America, and Wells Fargo, are expected to play a significant role in shaping market sentiment and influencing trading decisions. The combination of economic indicators and corporate earnings reports continues to be a focal point for investors navigating the dynamic landscape of financial markets.