Fed’s Rate Cut Signal and Tech Surge Driving Wall Street to Record Highs

- rabeelrana

HG MARKETS:

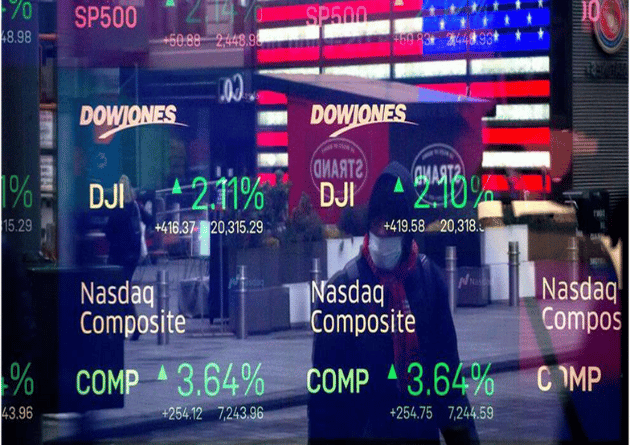

Wall Street recorded record highs for the second day in a row as it resumed its upward trajectory. The Federal Reserve’s hint of possible rate reduction and chip stocks’ sharp increase—largely driven by Micron Technology’s bullish prediction—supported the rally. Encouraged by strong earnings and promising economic data, the Dow moved closer to the 40,000 level even as Apple was facing an antitrust action. Reducing unemployment claims and a thriving housing industry also provided comfort to the market, demonstrating the durability of the economy. In other news, the U.S. Treasury yield curve—which represents the difference between the yields on two-year and 10-year bonds—has stayed inverted since July 2022, breaking the previous record that was set in 1978.

An impending recession is typically signaled by an inversion, which implies that investors are expecting extended periods of high short-term interest rates, which will eventually be followed by rate reductions to support the economy. Notwithstanding this indication, the U.S. economy has been supported by significant post-Covid household savings and the Fed’s persistent rate-cutting policy. However, long-term investing methods have historically faced difficulties due to the inversion.

In the world of commodities, spot gold slightly declined to $2,180.49 following a record high of $2,222.39, signaling a pause in the metal’s upward run. On the other hand, US gold futures increased 1.1% to $2,184.7. The dollar’s strengthening and market adjustments after aggressive buying contributed to the small decline.

However, the market for gold is still generally in a favorable mood due to predictions of significant central bank purchases and impending interest rate reduction in 2024.

A decrease in the demand for gasoline in the United States, combined with expectations of a ceasefire in Gaza and a strong dollar, put downward pressure on oil prices. The price of both U.S. and Brent oil futures dropped by 0.6%. A stronger dollar made oil more expensive for overseas consumers, and the possibility of a truce in Gaza, which might reduce tensions in the region and facilitate the transit of crude oil, also had a role in the fall. Furthermore, a decline in the demand for gasoline in the United States suggests that crude consumption may be slowing down.